Fuel Processing

Fuels are an essential component of the energy value chain. DAI can appraise and evaluate all stages of fuel processing from creation to transportation to delivery. Our extensive industry knowledge is critical to fully appreciating the role of fuels in the energy value chain.

Recent Experience: On behalf of a large regional lender, DAI monitored the construction of a biodiesel facility built in Danville, IL. As part of its duties, DAI advised the lender on the construction’s progress and budget, including the reasonableness of expenses, adherence to the proposed schedule, reasonableness of deviations from schedule and budget, and the ultimate performance of the plant.

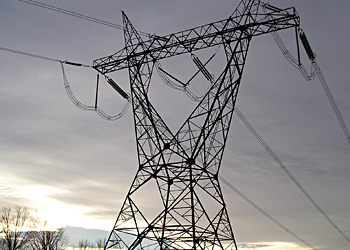

Electric Transmission

Transmission derives its value from connecting energy markets. A proper analysis of a transmission system, therefore, should include the economic dynamics of the energy markets whose activity it mediates. But transmission also constitutes a complex system governed by physical laws and guided in many cases by regulation. The nexus of these forces – economic, physical, and regulatory – determines the value of transmission and guides its evolution over time.

Recent Experience: For a large leasing firm, DAI appraised a high-voltage electric transmission system connecting the generation-rich upstate New York area with the energy-intensive southeast portion of the state. DAI’s appraisal addressed the evolving nature of transmission regulation and the potential for competing pathways into the constrained New York City market. In reviewing the possible future scenarios, DAI analyzed the likely options available to the lessor upon termination.

Drilling Rigs

The volatile nature of natural gas prices and the risks associated with gas exploration and production make the valuation of natural gas drilling rigs a complicated endeavor. In particular, their long-term economic outlook depends on modeling a highly cyclical industry, as well as understanding application-specific technological issues. DAI has both the technical know-how and the understanding of gas market economics to provide credible long-term value determinations for drilling rigs.

Recent Experience: For a large money center bank, DAI appraised a large portfolio of drilling serving rigs as collateral. Because of the nature of the transaction, the lender was concerned with the value of the rigs over time and under different market cycles. DAI developed a detailed rig economic model that illustrated the economic value of the rigs to the end user, rather than merely their current value as equipment.

Fuel Storage

Whether in tanks or in salt caverns, storage capacity is a challenging asset to value. It is both a cost center and a strategic asset. DAI’s appraisal and decision analysis expertise is critical when evaluating fuel storage assets because of their inherent optionality and unique role in the energy value chain.

Recent Experience: DAI appraised a fuel oil storage facility in Louisiana on behalf of its lessor. A key factor in the value of the storage facility was the prospect for future operation of the related dual-fuel power plant. A deep understanding of the regulatory and environmental constraints around running on fuel oil (as opposed to natural gas) was essential to the determination of the storage facility’s useful life. DAI evaluated the power plant’s fuel oil utilization, variable cost structure, and environmental limitations (under both current and likely future regulation), and also examined the alternatives available to the plant operators with regard to fuel delivery, processing, and usage. Based on DAI’s analysis, the lessor was able to successfully negotiate an extension to the existing lease.

- Drilling Rigs

- Electric Transmission

- Fuel Processing

- Fuel Storage

- Natural Gas Pipeline

- Rail and Transportation Assets

- Transmission