Fair Market Value Appraisal

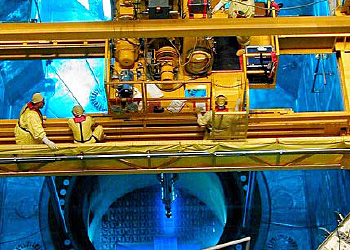

Nuclear power is a reliable energy source with the potential to address concerns over carbon emissions and climate change. DAI’s appraisal services have supported nuclear projects for a wide variety of investors and project participants. The complexity of modern nuclear plants makes technological proficiency essential when appraising nuclear power plants. DAI’s staff includes former Navy nuclear engineers, as well as former executives of nuclear equipment manufacturers, providing a diverse array of experience with nuclear power generation.

Recent Experience: For two large banks, DAI provided an appraisal of two nuclear projects to support a like-kind exchange of lease interests. The like-kind exchange appraisal required careful consideration of both the technological and economic factors central to both facilities in order to meet IRS requirements.

Market Studies

Today’s energy markets are complex. A DAI market study can help investors, lenders, and lessor evaluate both the demand-side and supply-side characteristics of a regional market, including long-run energy demand, capacity additions and retirements, commodity prices, and potential regulatory activity. DAI’s price forecasts are derived from a proprietary power market model developed in conjunction with faculty at Carnegie Mellon University.

Recent Experience: On behalf of a very large money center bank, DAI provides a quarterly market review of the bank’s nuclear project portfolio, which includes lease interests in several nuclear projects across the country. DAI’s evaluations of market conditions are used to assess the value of the projects under a variety of different potential future market and regulatory conditions and assess the financial and strategic value of the projects’ residual positions.

Decommissioning Expense Evaluations

Decommissioning a nuclear power plant is a time-consuming and costly undertaking. Over the next few decades, many plants will be approaching the end of their physical lives and will require decommissioning. Because of the scale and costs involved, and the lack of many other examples as reference cases, project owners are keenly interested in their financial decommissioning responsibilities and how those responsibilities might vary under different market and regulatory conditions.

Recent Experience: For a large leasing company, DAI reviewed the current status of decommissioning funds and the current lease for a large southwestern nu-clear plant. Based on lease requirements and expectations of future decommissioning expenses, certain calculations were made to determine potential lessor liability and comment on how such language influences the determination of the fair market value of the project.

- Decommissioning Expense Evaluations

- Energy Price Forecasts

- Fair Market Value Appraisal

- Federal Loan Guarantee Support

- Independent Engineering Services

- Litigation Support

- Market Study

- Property Tax Valuation